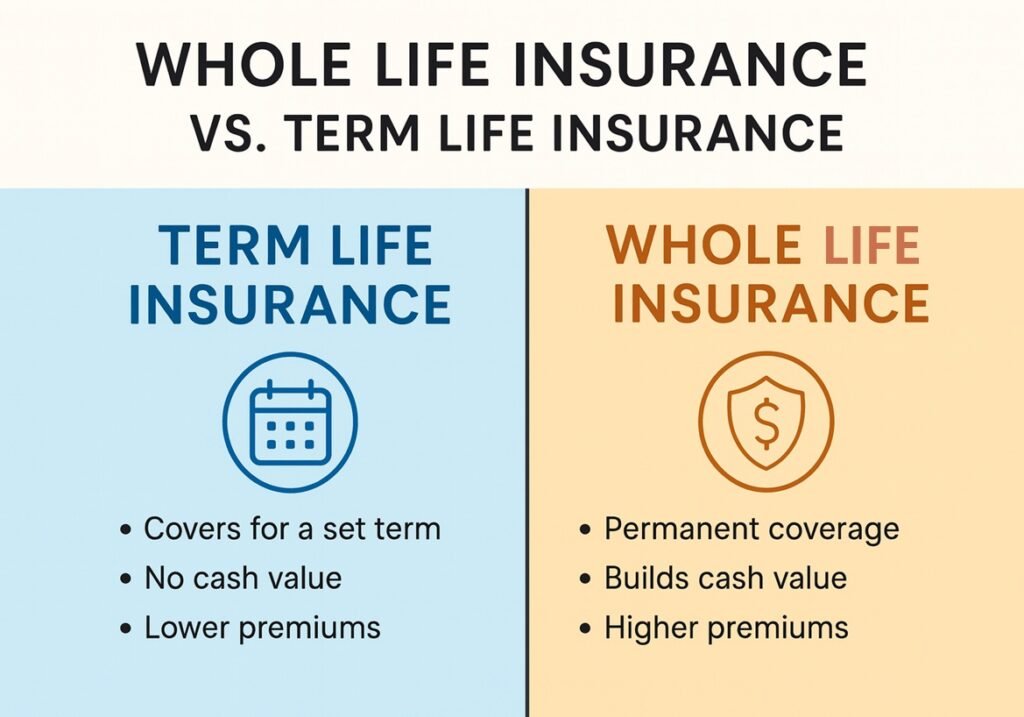

Whole Life vs. Term Life Insurance — Which Saves You More in the Long Run?

Ever stared at an insurance comparison chart and felt your brain quietly slip out the back door? Same. You click through quote after quote, wondering whether term life or whole life is the “adulting” choice—and which one actually saves you money. Here’s the truth: insurance companies don’t make this easy. Term life insurance feels cheap […]

Whole Life vs. Term Life Insurance — Which Saves You More in the Long Run? Read More »