Ever stared at an insurance comparison chart and felt your brain quietly slip out the back door? Same. You click through quote after quote, wondering whether term life or whole life is the “adulting” choice—and which one actually saves you money.

Here’s the truth: insurance companies don’t make this easy. Term life insurance feels cheap and straightforward. Whole (or permanent) life promises lifelong coverage, a cash value, and fancy extras. But which one leaves you with more dollars in your pocket decades from now? Let’s break it down in a warm, judgment-free way—like a friend walking you through it on a Sunday morning with coffee.

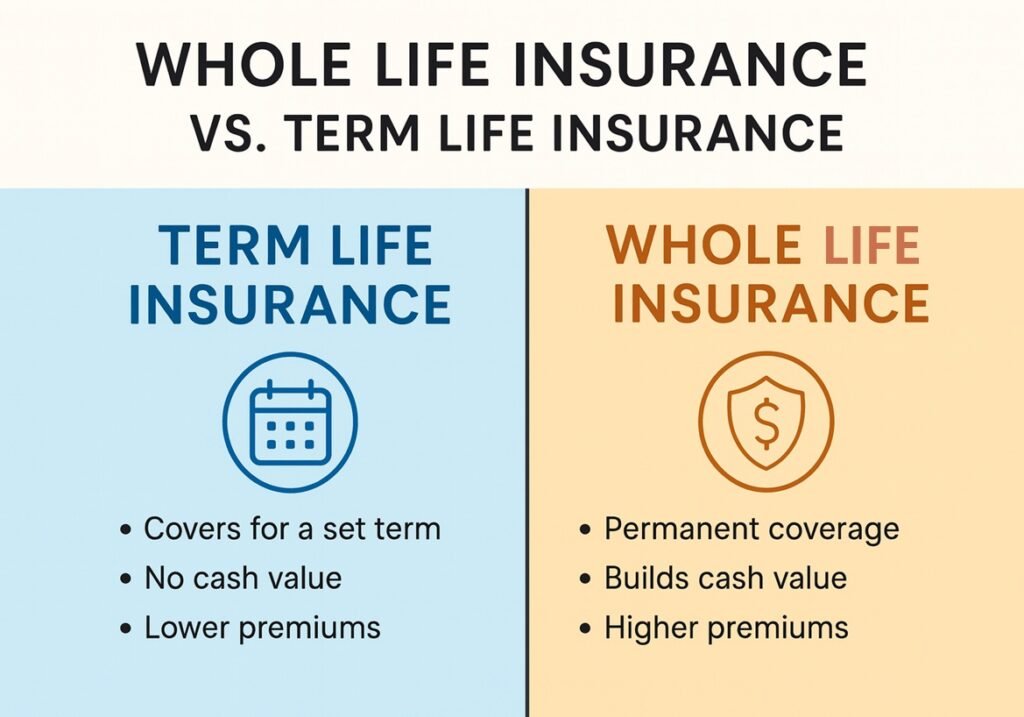

What’s the Real Difference? (Simple, I Promise)

Before diving into savings, it helps to understand what each product actually is.

✨ Term Life Insurance (aka “the budget-friendly option”)

- Covers you for a set term—think 10, 20, or 30 years.

- Pure insurance: no cash value, no investing.

- Low monthly payments (often 5–10x cheaper than whole life).

- Designed to protect you during high-risk years (mortgage, raising kids, debt).

✨ Whole Life Insurance (aka “the everything-in-one package”)

- Permanent coverage—lasts your entire life.

- Builds cash value over time (tax-deferred).

- Predictable premiums, but significantly higher.

- Can borrow against cash value—but loans reduce your death benefit until repaid.

Expert Insight:

According to the Consumer Financial Protection Bureau, whole life’s cash value growth is often slow in early years and shouldn’t be treated as a primary investment tool. Use it for long-term stability—not quick gains.

Which One Actually Saves You Money?

Here’s the million-dollar question (literally).

💸 In Terms of Premiums, Term Wins

If your goal is maximizing savings today, term life insurance beats whole life every time.

Example:

- 30-year-old healthy nonsmoker

- $500,000 coverage

- Term (20 years): ~$25–$35/month

- Whole Life: $300–$500+/month

That’s a difference of $3,000–$5,500 per year. Imagine investing that gap—your future self will want to hug you.

Where Whole Life Can Save You (But Only If You Play the Long Game)

Whole life does offer long-term value if you’re the kind of person who:

- Wants guaranteed lifelong coverage

- Likes the idea of building cash value without market volatility

- Plans to keep the policy for 20+ years

- Values estate planning tools (e.g., passing wealth tax-efficiently)

Pros of Whole Life (Long-Term)

- Guaranteed payout (as long as premiums are paid).

- Cash value you can borrow against for emergencies.

- Useful for high-income earners who’ve maxed out 401(k)s and IRAs.

Cons

- High upfront and ongoing costs.

- Cash value grows slowly at first.

- Canceling early often means losing money.

Crunching the Long-Run Numbers (Easy Math Version)

Imagine putting the difference between whole life and term premiums into an index fund averaging 6–8% annually.

If you invested an extra $300/month for 30 years, you could end up with:

- $300/month @ 7% for 30 years = ~$340,000

Meanwhile, the average whole life cash value after 30 years is often $100k–$200k, depending on the policy.

Conclusion:

If pure savings + growth is your priority, term + investing the difference often wins financially.

So… Which Should YOU Choose?

Ask yourself these quick questions:

1. What’s your budget?

If your cash flow is tight → Term.

It frees up money for investing, debt payoff, and emergency funds.

2. Do you need lifelong coverage?

If yes (e.g., dependent with special needs or estate planning) → Whole life may make sense.

3. Are you disciplined with investing?

If no → the forced savings of whole life can help.

If yes → term + investing the difference = more freedom and growth.

Hybrid Option: Term Now, Convert Later

Many insurers offer convertible term policies, letting you switch to permanent coverage without a new medical exam—huge if your health changes.

Ask your insurer:

“Is this term policy convertible, and until what age?”

The Bottom Line (and My Honest Take)

If you’re young, budget-conscious, or focused on building wealth:

👉 Term life insurance saves you more money long-term.

If you want lifelong guarantees and a built-in savings vehicle—and can afford the premiums:

👉 Whole life can be a stable long-term solution.

There’s no wrong answer—just what aligns with your life and financial goals today.

What’s Your Move? (Tell Me Below!)

Have you ever compared term life and whole life quotes? What surprised you most? Drop your thoughts or questions in the comments—someone else is definitely wondering the same thing.

P.S. Want more practical money tips? Hit subscribe for weekly guides that help you save smarter.