Refinancing your mortgage sounds like a smart move—lower rates, smaller payments, extra cash. But here’s the part no one loves to talk about: refinancing isn’t always worth it, even when rates drop.

In 2026, homeowners are facing a tricky mix of higher-for-longer interest rates, tighter lending standards, and rising home values. That makes the refinance decision less about hype and more about math.

So when does refinancing a mortgage actually make sense? Let’s break it down in plain English—no lender jargon, no sales pitch.

What Refinancing Really Does (Quick Refresher)

Refinancing replaces your current mortgage with a new one—ideally with better terms.

People refinance to:

- Lower their interest rate

- Reduce monthly payments

- Change loan length (30 → 15 years)

- Switch loan types (ARM → fixed)

- Tap home equity with cash-out refinancing

But every refinance comes with closing costs, which is where many people get tripped up.

1. Refinancing Makes Sense When Rates Drop Enough

The classic rule of thumb used to be: refinance if you can lower your rate by 1%.

In 2026, that rule is outdated.

A Better Rule for 2026:

- 0.75% drop → usually worth a look

- 0.5% drop → depends on fees & timeline

- <0.5% drop → rarely worth it

Why? Because closing costs often range from 2%–5% of the loan amount.

💡 Example:

On a $350,000 mortgage, a 0.75% rate drop could save ~$180/month—but only if you stay in the home long enough.

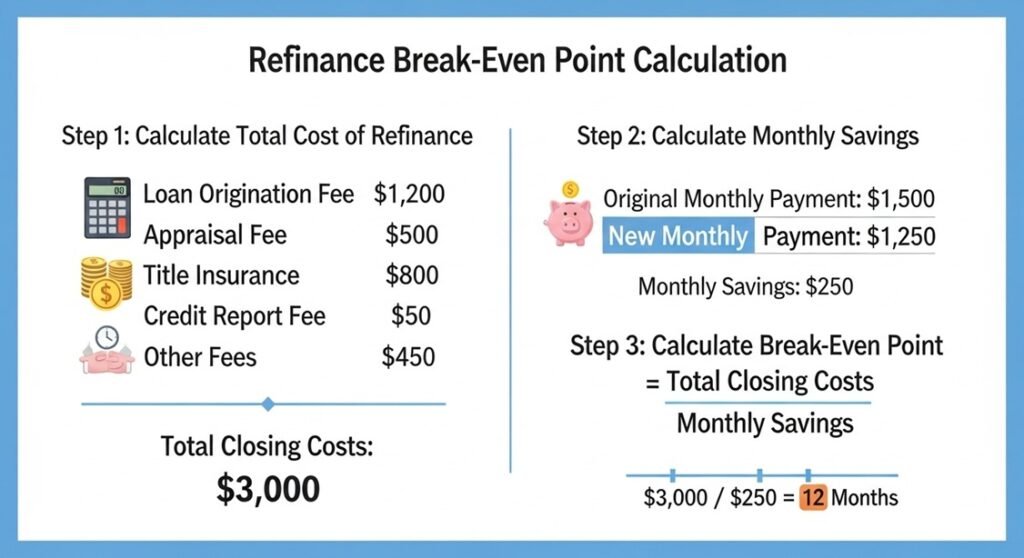

2. The Break-Even Point Is the Real Decider

The break-even point is how long it takes for your monthly savings to cover refinance costs.

Simple Formula:

Total refinance costs ÷ monthly savings = months to break even

If:

- Your break-even point is 36 months

- But you plan to move in 2 years

👉 Refinancing probably doesn’t make sense.

This is one of the most important steps—and one lenders don’t always highlight.

3. Refinancing Can Make Sense Even If Rates Aren’t Lower

Surprise: lower rates aren’t the only reason to refinance.

Smart Non-Rate Reasons to Refinance:

- Switching from an ARM to a fixed-rate loan

- Shortening your loan term to build equity faster

- Removing PMI after gaining equity

- Consolidating high-interest debt (carefully)

According to the Consumer Financial Protection Bureau, refinancing for stability or risk reduction can be just as valuable as saving money.

4. Cash-Out Refinancing: Powerful but Risky

Cash-out refinancing lets you borrow against your home’s equity—but it’s not free money.

When Cash-Out Can Make Sense:

- Home improvements that increase value

- Paying off high-interest credit card debt

- Emergency financial restructuring

When It’s a Bad Idea:

- Funding lifestyle spending

- Covering chronic budget issues

- Betting on rising home prices

You’re turning unsecured debt into debt tied to your home. That’s a serious trade-off.

5. Your Credit and Equity Matter More in 2026

Lenders in 2026 are stricter than they were pre-2020.

Most lenders want:

- Credit score: 700+ for best rates

- Equity: At least 20% (especially for cash-out)

- Debt-to-income ratio: Below 43%

If your credit has improved since you first bought your home, refinancing may unlock much better terms than you originally had.

👉 How to Raise Your Credit Score by 50 Points in 60 Days

6. Watch the Fed—but Don’t Wait Forever

The Federal Reserve influences mortgage rates indirectly, but waiting for “perfect” conditions can cost you real savings.

Smarter Strategy:

- Refinance when the payment works for your budget

- Avoid timing the absolute bottom

- Refinance again later if rates drop further

Yes—people refinance more than once. That’s normal now.

Quick Checklist: Does Refinancing Make Sense for You?

Refinancing may be a smart move if you can check 3 or more of these boxes:

✔ You’ll stay in the home past the break-even point

✔ Your rate drops by at least 0.5–0.75%

✔ Your credit score has improved

✔ You can remove PMI

✔ You want long-term payment stability

✔ Closing costs don’t wipe out savings

If not? Waiting might be the better financial move—and that’s still a win.

Final Takeaway

Refinancing isn’t about chasing headlines—it’s about running the numbers.

In 2026, the smartest homeowners refinance with:

- Clear timelines

- Realistic savings goals

- A plan (not hope)

When refinancing fits your life and your math, it makes sense. When it doesn’t? Skipping it can be the smartest move of all.

Bankrate: Types of mortgage refinance