I’ve been there—the moment you get a weird email from a bank you don’t recognize, your heart drops a little. Did someone open an account in my name?

With data breaches happening almost weekly and scammers getting smarter, protecting your identity has become as basic as locking your front door. One of the simplest, most powerful defenses? Freezing your credit.

A credit freeze sounds intense, but it’s actually quick, free, and gives you a major layer of security. According to the Federal Trade Commission, identity theft remains one of the top consumer complaints each year—so taking a few minutes to freeze your credit can spare you thousands in stress and potential losses.

Let’s walk through exactly how to do it and why it’s worth it.

Why Freezing Your Credit Works (Primary Keyword: Credit Freeze)

A credit freeze blocks new lenders from pulling your credit report. If a scammer tries to apply for a loan or credit card using your info, the lender can’t verify your credit—so the application gets denied.

Think of it as putting a lock on your financial front door.

And the best part? It doesn’t affect your score, your existing accounts, or your day-to-day life.

Top Benefits of a Credit Freeze

- Stops identity thieves from opening new accounts.

- Free and reversible—thanks to U.S. law.

- No impact on credit score (confirmed by CFPB).

- Quick to unfreeze when you need it—often within minutes.

- Peace of mind for anyone who’s dealt with data theft or major breaches.

“A credit freeze is one of the most effective tools consumers have to prevent new-account fraud.” — Consumer Financial Protection Bureau

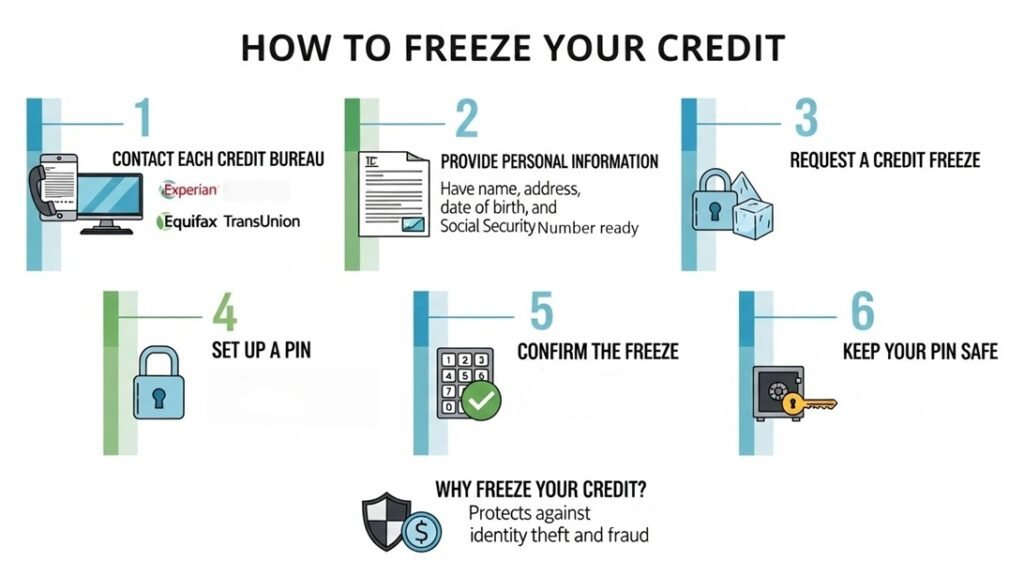

How to Freeze Your Credit in 10 Minutes or Less

Freezing your credit means placing a freeze at all three major bureaus. It’s not automatic—each one must be done separately (but don’t worry, it’s fast).

Below is your step-by-step guide.

1. Equifax Credit Freeze

- Visit: equifax.com/personal/credit-report-services/

- Or call: 1-800-685-1111

- You may need: Social Security number, address history, and access to your email/phone.

- They’ll provide a PIN or account login for future unfreezes.

2. Experian Credit Freeze

- Visit: experian.com/freeze/center.html

- Or call: 1-888-397-3742

- Set up a personal account to manage freezes/unfreezes online.

3. TransUnion Credit Freeze

- Visit: transunion.com/credit-freeze

- Or call: 1-888-909-8872

- Create or log in to a TransUnion account to complete the freeze.

Temporary Thawing: When You Need to Unfreeze Your Credit

Planning to apply for a new apartment, credit card, auto loan, or cell phone plan?

You’ll need to temporarily unfreeze your credit.

Two Ways to Unfreeze Your Credit

1. Lift the freeze for a specific lender

Great when you know exactly who will run the credit check.

2. Lift the freeze for a timeframe

Example: 24 hours or 7 days. After that period, the freeze automatically restores.

Most bureaus process this instantly online—but allow 5–10 minutes before the lender runs your report.

Is a Credit Lock the Same as a Credit Freeze?

Not quite.

A credit freeze is free and governed by federal law.

A credit lock is a paid subscription service (usually from Experian or TransUnion) that offers app-based locking/unlocking plus extra monitoring tools.

Freeze vs. Lock — Quick Comparison

- Cost: Freeze = Free; Lock = Paid subscription

- Legal protection: Freeze is regulated; lock is a product

- Ease: Locks are slightly faster (toggle via app), but freezes are nearly as quick

Unless you want bundled monitoring tools, a credit freeze works for most people.

Who Should Freeze Their Credit? (Hint: Pretty Much Everyone)

A credit freeze is recommended for:

- Anyone who’s been in a data breach (that’s most of us by now)

- Children and teens who have clean credit files

- Older adults who may be targets for scams

- People rebuilding or protecting their credit

- Anyone who wants to avoid identity fraud—even if your credit is great

It’s one of the easiest financial “set it and forget it” protections out there.

Common Myths About Credit Freezes — Debunked

“It hurts my credit score.”

Nope. Your score is untouched.

“It affects my credit cards.”

Your current accounts work normally.

“It makes applying for loans impossible.”

You can instantly unfreeze—no need to talk to a live agent.

“It’s too complicated.”

Most people set all three freezes in under 10 minutes.

Final Thoughts: Protecting Your Wallet Starts With One Simple Step

If you want a no-cost, low-effort way to shield your financial life from identity thieves, freezing your credit is a must-do. Think of it as digital self-defense—one that future-you will absolutely thank you for.

Have you tried freezing your credit yet? Did anything surprise you during the process?

Drop your experience or questions in the comments—I’d love to hear them!

And if you’re diving deeper into personal security, check out related posts and subscribe for weekly smart-money tips.