When Does Refinancing a Mortgage Actually Make Sense?

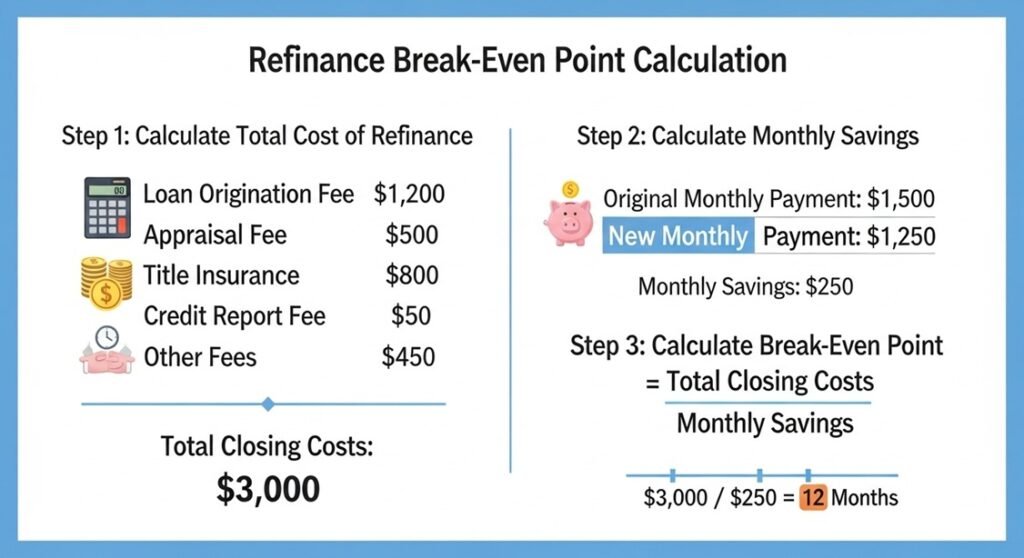

Refinancing your mortgage sounds like a smart move—lower rates, smaller payments, extra cash. But here’s the part no one loves to talk about: refinancing isn’t always worth it, even when rates drop. In 2026, homeowners are facing a tricky mix of higher-for-longer interest rates, tighter lending standards, and rising home values. That makes the refinance […]

When Does Refinancing a Mortgage Actually Make Sense? Read More »