If you’ve ever checked your credit score and immediately closed the app like “nope, not today,” you’re not alone. I’ve been there—wondering how a few late payments snowballed into a number that suddenly controls loan approvals, interest rates, and even rental applications.

Here’s the good news: a 50-point credit score increase in 60 days is absolutely possible—especially if your score is currently fair or poor. Credit scores respond quickly to the right actions. You don’t need gimmicks, expensive credit repair companies, or perfect finances. You just need a focused, strategic plan.

Below is a realistic, step-by-step approach that works with how credit scoring models actually behave today (current as of January 2026).

Step 1: Fix Credit Report Errors Immediately (Days 1–7)

This is the fastest potential win. According to the Consumer Financial Protection Bureau, errors on credit reports are common—and correcting them can lead to rapid score improvements.

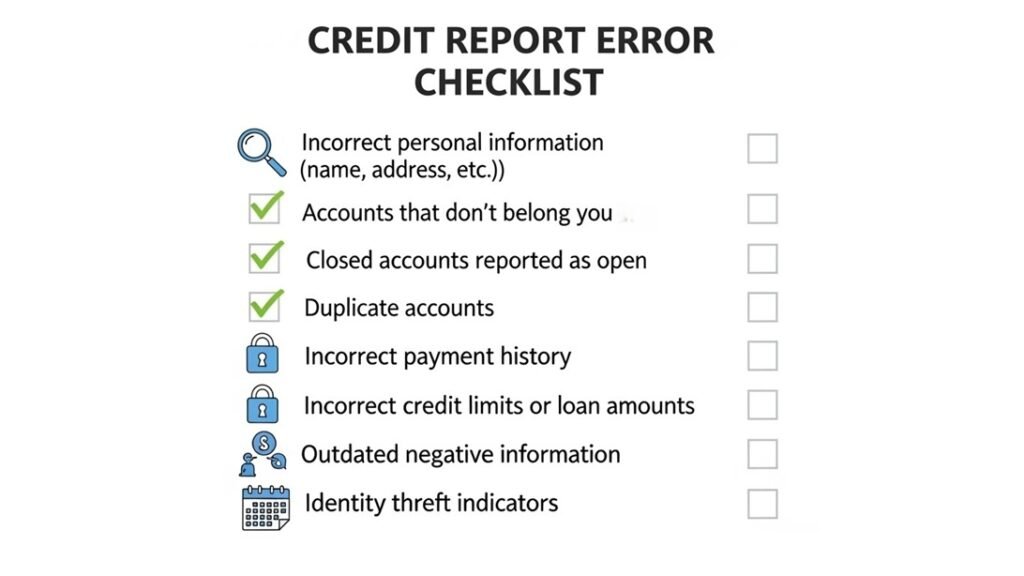

What to look for:

- Accounts you don’t recognize

- Late payments you know you paid on time

- Incorrect balances or credit limits

- Duplicate collection accounts

What to do:

- Pull reports from all three bureaus (Experian, Equifax, TransUnion).

- Dispute errors online with documentation.

- Follow up within 30 days (many updates happen sooner).

Why this works: Removing one wrongly reported late payment or collection can instantly unlock points.

Step 2: Pay Down Credit Card Balances (Days 1–30)

Your credit utilization ratio—how much of your available credit you’re using—accounts for a massive portion of your score.

Target benchmarks:

- Below 30% = good

- Below 10% = excellent (and score-boosting)

Smart moves:

- Focus on one or two cards first, not all of them.

- Even paying balances down to just under a utilization threshold can trigger a jump.

- If cash is tight, consider:

- Extra payment before the statement closing date

- Temporary spending freeze on credit cards

Real talk: This step alone often delivers 20–40 points.

Step 3: Add Positive Payment History Fast (Days 15–45)

Payment history is the single most important credit factor. You want more on-time payments reporting now.

Fast-track options:

- Become an authorized user on a well-managed, old credit card

- Open a secured credit card (reports immediately)

- Use a credit-builder loan through a credit union or fintech app

Tip: Make sure the account reports to all three bureaus.

Why this works: New positive data offsets old mistakes faster than most people realize.

Step 4: Eliminate Small Negatives (Days 30–60)

Collections—especially small ones—can drag your score down disproportionately.

What to prioritize:

- Medical collections (often easier to remove)

- Old utility or phone bills

- Balances under $500

Strategy:

- Negotiate “pay for delete” in writing.

- Never pay blindly—always confirm removal terms first.

- Get confirmation before sending money.

Score impact: Removing just one collection can be worth 10–30 points.

Step 5: Don’t Accidentally Undo Your Progress

This is where many people slip up.

Avoid these for 60 days:

- Applying for new credit unnecessarily

- Closing old credit cards

- Missing any payment (even one)

- Maxing out cards “just for a moment”

Set autopay. Put reminders everywhere. Protect the gains you’re building.

What a 50-Point Jump Actually Looks Like

Here’s a realistic scenario:

- +15 points from disputes

- +25 points from utilization drops

- +10 points from new positive history

➡️ Total: 50 points in ~60 days

Not magic. Just math and consistency.

Final Thoughts: Momentum Matters

Credit improvement isn’t about being perfect—it’s about being intentional. Once you see that first jump, motivation skyrockets, and better financial options start opening up.

If you stick with these steps, you’re not just raising your score—you’re changing how lenders see you.

Your turn:

What’s the first credit move you’re making this week? Drop it in the comments 👇