How to Boost Your Credit Score in 90 Days

Picture this: It’s November 2025, and you’re eyeing that dream apartment in a bustling city, but your credit score—hovering around the national average of 715—keeps throwing up roadblocks. Higher scores mean lower interest on loans, cheaper insurance premiums, and more financial freedom. The good news? You don’t need a finance degree or endless patience. With focused effort, many people see improvements of 50 points or more in just 90 days. I’ve helped friends climb from “fair” to “good” territory using these steps—now it’s your turn. Let’s break it down into a simple, 90-day plan.

Step 1: Assess Your Credit Baseline (Days 1-7)

Before you dive in, know where you stand. The FICO score model, used by 90% of lenders, weighs factors like payment history (35%) and credit utilization (30%). Start by pulling your free credit reports from AnnualCreditReport.com—do this weekly to track progress.

- Check for errors: Look for wrong personal info, outdated accounts, or fraudulent charges. Dispute inaccuracies online via Equifax, Experian, or TransUnion; fixes can add 20-100 points quickly.

- Get your score: Use free tools like Credit Karma or Experian’s app for a baseline FICO/VantageScore snapshot.

- Set a goal: Aim for 670+ (good range) if you’re below average. Track in a simple spreadsheet.

Pro tip: As of November 2025, economic shifts like rising rates make this timing perfect—lenders are scrutinizing scores more than ever.

Step 2: Master On-Time Payments (Days 8-30)

Payment history is your score’s biggest driver. Missing even one bill can ding you 100 points, but consistency rebuilds trust fast.

Here’s a 30-day payoff:

- Automate everything: Set up autopay for credit cards, loans, and utilities. Apps like Mint or YNAB (You Need A Budget) send reminders.

- Catch up on lates: If you’re behind, prioritize minimums on revolving debt. Contact creditors for hardship plans—many waive fees in 2025’s forgiving market.

- Build habits: Use a 90-day calendar to mark payments. Reward yourself after 30 spotless months (e.g., a coffee treat).

Expect 20-40 point gains here alone, per Experian data. Remember, reporting lags 30-45 days, so stay vigilant.

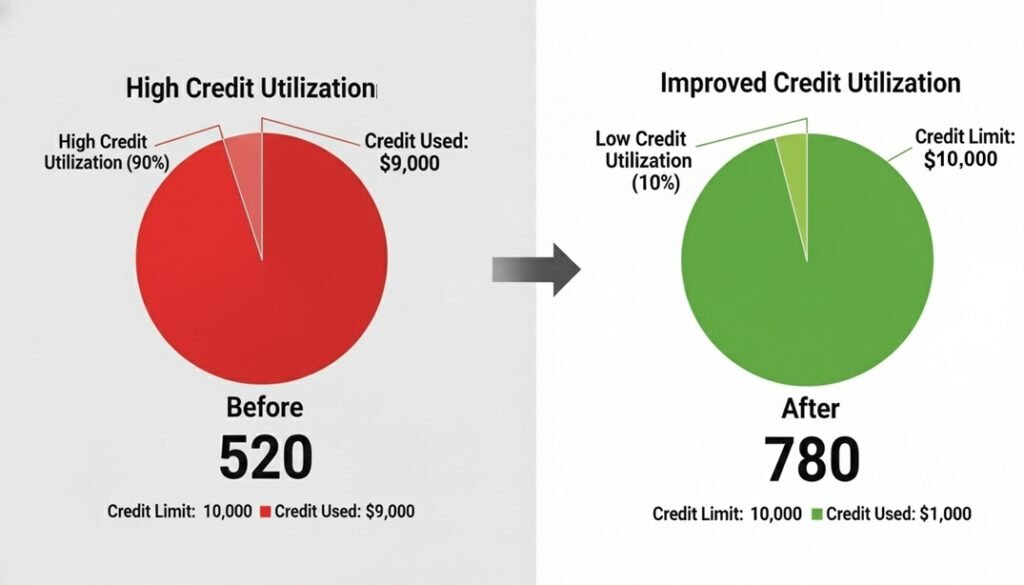

Step 3: Slash Credit Utilization (Days 31-60)

High balances? They’re like red flags to lenders. Keep utilization under 30% of your limits—dropping from 80% to 20% can boost scores by 50 points overnight.

Target high-impact moves:

- Pay down cards aggressively: Focus on cards with balances over 50% first. Use the debt snowball: Pay minimums on all, extra on the smallest balance for quick wins.

- Request limit increases: If you’ve been responsible, ask issuers for higher limits (without a hard inquiry). This lowers utilization without extra spending.

- Avoid charges: Freeze cards in ice (literally) to curb impulse buys. Track via apps to stay under 10% ideally.

By day 60, recheck reports—many see utilization drop to single digits, unlocking better loan terms.

Step 4: Add Positive Credit History (Days 61-80)

Don’t just fix—build. Tools like Experian Boost let you add on-time rent, utilities, and streaming payments to your report instantly, adding up to 20 points for free.

Quick boosters:

- Enroll in Boost: Link bills via Experian—eligible users (often renters) qualify in minutes.

- Become an authorized user: Ask a trusted family member with stellar credit to add you to their card (ensure they pay on time).

- Secured cards: If thin on history, get a starter card like the Capital One Platinum—use lightly and pay off monthly.

These steps diversify your mix without risk, per CFPB guidelines.

Step 5: Protect Your Progress (Days 81-90)

Gains are fragile—lock them in:

- Freeze your credit: Prevent fraud with free freezes at the bureaus.

- Limit applications: No new credit; each hard inquiry costs 5-10 points for a year.

- Monitor monthly: Set alerts for changes.

You’ve done the work—celebrate with a score check on day 90. Many hit 750+, qualifying for prime rates.

Ready to transform your finances? These tips aren’t magic, but they’re backed by experts and work for real people. What’s your biggest credit hurdle? Share in the comments—I read every one! For more, subscribe to our newsletter for weekly smart living hacks.